Tax Blog

Tips to help you prepare for tax season

The latest tax tips and news from Stears General and Tax Accounting Services

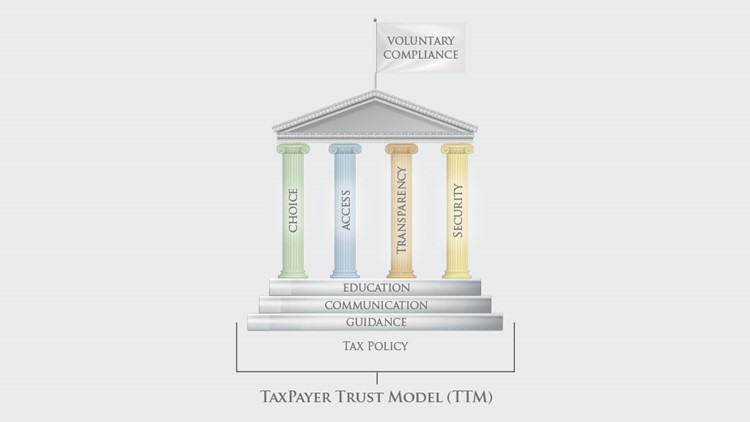

ETAAC Lays Out its 2023 Recommendations

The ETAAC released recommendations to improve electronic income tax filing in their 2023 annual report. The document asks the IRS to update their procedures and details legislation and other recommendations for both Congress and the IRS. Drake Software covers their Taxpayer Trust Model and the proposed changes in our recent blog post.… Read more about ETAAC Lays Out its 2023 Recommendations (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Unveils Timetable for Completely Paperless Filing by 2025

The IRS has constructed a blueprint for its future called the Paperless Processing Initiative. This plan cuts back on paper filing with the purpose of decreasing the number of printed documents it needs to process each year and speeds up tax refunds. Our latest blog post describes these intended changes and what they mean for tax professionals.… Read more about IRS Unveils Timetable for Completely Paperless Filing by 2025 (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Drake Software Hits the Road This Summer: Join Us at IRS Tax Forums and Trade shows!

Summer events for the tax industry are in full swing as professionals from around the country gather to share resources, insight, software, and tools for the 2024 filing season. Our latest blog post is all about trade shows and events!… Read more about Drake Software Hits the Road This Summer: Join Us at IRS Tax Forums and Trade shows! (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

IRS Announces Direct Deposit for Amended Returns

Filing an amended return used to mean completing a paper form, regardless of how taxpayers submitted the original return to the Internal Revenue Service. During the pandemic, paper-filed returns… Read more about IRS Announces Direct Deposit for Amended Returns (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

2022 Special State Payments Not Taxable

In 2022, millions of Americans received special state-issued payments designed to provide economic relief to residents struggling with financial burdens exacerbated by issues ranging from the pandemic to natural disasters. One week after urging recipients to postpone filing their returns, the Internal Revenue Service has issued official guidance regarding the federal taxability of those payments.… Read more about 2022 Special State Payments Not Taxable (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…

Clean Vehicle Credit Guidance Revises Classifications

As part of the Inflation Reduction Act of 2022, lawmakers made changes to the Clean Vehicle Credit that were meant to encourage the purchase of U.S.-made electric and fuel cell vehicles. Unfortunately, the criteria for qualifying vehicles has proven confusing for some taxpayers.… Read more about Clean Vehicle Credit Guidance Revises Classifications (Feed generated with FetchRSS) – Story provided by TaxingSubjects.com…